Several Forex traders tend to believe that if they trade often, they will have more opportunities and thus they’ll make more money. Now that is not the right approach because high-frequency trading just causes unnecessary stress and frustration that could end up making you do low-probability trades. In fact, when you are sure of your trading edge and when is the right time to trade it, you would not bother about trading often. There are plenty of cases that prove that day traders and scalpers end up making less money typically as compared to lower-frequency traders. Visit multibankfx.com

High-Frequency Trading

“High-frequency trading” (HFT) stands for an investment vehicle that is mostly automated and works with powerful computers to carry out transactions for a big number of orders at great speeds.

Typically something that big investment banks, hedge funds, and institutional investors prefer to work with, HFT enjoys considerable popularity amongst scalpers and day traders. It is so because then the users get a chance to earn from the live market volatility and price fluctuation in the forex markets as well as other financial markets that operate similarly.

Since HFT has the capacity to carry out millions of orders at once, traders have the option to maximize their short-term gains in the market, which gives large institutions a great edge over individual investors in the open marketplace.

HFT could manipulate the market in an unjust way. The volatility this causes can throw off risk-averse investors.

In this particular article, high-frequency trading would not indicate the multiple fast-paced trades which are put in place by automated trading algorithms. In fact we will focus more on the multiple trades that human retail traders place on short-term charts. It is the trading style that a number of retail traders in the market follow today. The belief that the more trades result in more money is farce.

Particularly when we talk about it in the context of Forex trading, it does not hold true at all. The key is to spend less time in the market so you’re able to have a clearer head when it comes to choosing trades that have very high reward-to-risk potential. Stare at charts for longer than necessary and the following traps could befall:

- You tend to overestimate your trading capacity and technical capabilities.

- You may end up using important margins and don’t leave out much for future high-probability trade opportunities.

- You’re too impatient to let opportunities fall well into place.

- A begin to see non-existent trading opportunities.

- You trade too much and begin chasing the market to make up for your losses.

Low-Frequency Trading

On the other hand, low-frequency trading implies that you trade a few orders in a monthly cycle.

This is something that investors with a long-term outlook (such as swing or position traders) like to practice. This is because low-frequency trading is believed to be a lower-risk strategy and one where investors need to keep positions open for weeks or months.

These trades have better chances of being conceived and created on the basis of long-term charts (such as daily charts), since the goal is to earn better returns in the long term.

You might as well try to create a trade on the daily chart which would be completed within 2 weeks. You need to pick what is better: Carrying out four trades a month which could deliver up to 400 pips on a trade, or going after multiple trades where you earn only 20 or 30 pips per trade and there is a higher loss probability.

Trading Trends

A majority of position and long-term traders are already aware that daily charts are more apt when it comes to trend indication than short-term charts. Typically, trends happen in three different phases:

(1) major trends which could carry on for over 6 months

(2) intermediate trends which are essentially corrections of the primary trend

(3) minor trends that are like a hullabaloo on shorter-term time frames.

What could appear like an uptrend in a short-term chart could in fact be an upside retracement (intermediate trend) on a daily chart.

Because institutional traders who manage market volume trade on long-term charts, it is rather similar to a large current of water in a sea causing a small boat to move. You will be able to sail a small boat only in the absence of a counter current. When that large counter current comes, the most perfect small boat rowers will face the repercussions.

Low-frequency trading is better in the following ways:

- You don’t spend too much time before your computer screen which is simply healthier.

- There are better chances of trading with the trend.

- Your workload in terms of trading is reduced.

- Each trade brings greater potential for reward-to-risk.

- The trade setups of low-frequency trades tend to have greater probability as compared to high-frequency trades.

- You simply end up with more time to spend on other aspects of life.

Currency pairs and trade timings

HFT systems in the forex market boost liquidity of the market overall and also of individual forex pairs. Investors would typically act on the pairs that are liquid and relatively stable, to balance out risk and reward.

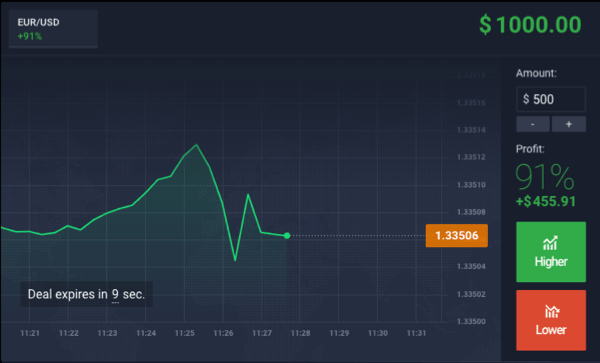

For instance, we know that the dominant EUR/USD pairing is hands down the single most liquid asset that you get access to when you download the MT4. This implies that buying and selling the pair in real time is fairly simple.

In a similar way, today it is a popular and also reliable forex pair in the market if you see its historical trading range. This enables investors to aim at the price targets that may be small but also recurring so optimal profit can be achieved.

Traders may certainly look at less liquid as well as extremely volatile exotic pairs too in order to boost their potential returns. However, it would also simultaneously increase your risk and market exposure. Know more plataforma mt5

When it comes to timings, HFT strategies work best when used when the market is extremely volatile such as when the trading session overlaps another. It helps in taking the levels of volume, liquidity, and volatility to the optimum level.