Hong Kong is one of the most prosperous cities in the world, and its financial sector is a significant contributor to that prosperity. FX trading is vital to the Hong Kong economy, and many commodities are popular for currency speculation in this vibrant city-state. In this article, we’ll look at some of the most popular commodities for FX trading in Hong Kong and explore why they are so popular among traders. Stay tuned for insights into the Hong Kong FX market.

Popular commodities for FX trading in Hong Kong

One of the most popular commodities for FX trading in Hong Kong is gold. Gold has long been a trusted store of value and is considered one of the safest assets to own in times of market volatility and economic uncertainty. As such, investors in Hong Kong often turn to gold to protect their investments from fluctuations in the forex market.

Another commonly traded commodity in Hong Kong is oil. As one of the world’s leading producers and consumers of oil, Hong Kong relies on this commodity for many aspects of its economy, including transportation needs and manufacturing processes. Because forex traders are always looking for new opportunities to take advantage of price fluctuations, they often speculate on movements in the price of oil when making their trades.

Other popular commodities for FX trading in Hong Kong include agricultural commodities, such as soybeans and wheat, and precious metals, like silver and platinum. These commodities are all sought after by forex traders due to their volatility and potential for significant price movements, making them ideal assets to trade on the forex market. Whether you’re a seasoned trader or just starting, the commodities available in Hong Kong’s vibrant forex market make it an exciting place.

What factors influence commodity prices, and how can traders take advantage of these movements?

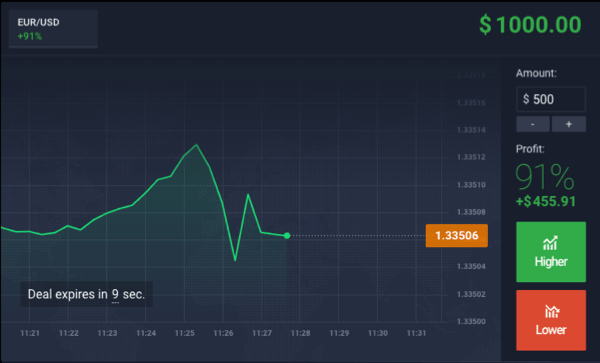

One of the critical factors that affect commodity prices is supply and demand. When a commodity is in high demand, the price tends to rise as buyers compete for limited quantities. Traders can take advantage of these fluctuations by using forex trading platforms to buy commodities when they are relatively cheap and sell them when they become more expensive.

Another important factor is economic news and data releases. For example, if economic growth figures indicate that an economy is slowing down, this typically results in lower commodity demand and a reduction in prices. As forex traders can access real-time market data, they can keep track of significant events like these and adjust their trading strategies accordingly.

Are there any risks associated with trading commodities, and how can you minimize them?

There are many risks associated with forex trading in Hong Kong, and traders should be aware of these potential hazards before they begin speculating on commodity prices. One risk is the possibility of volatility in the market due to unexpected events or economic data releases that can cause rapid price fluctuations and affect your trades. To mitigate this risk, it is vital to keep a close eye on market news and use technical analysis tools such as trend lines, support levels, and resistance points to help guide your decision-making process.

Another risk is the possibility of high transaction costs if you trade forex through an online broker. Many forex brokers charge fees for each trade, which can be costly over time. To minimize these costs, it is vital to shop around and find a forex broker that offers low transaction fees and features round-the-clock customer support and access to advanced trading tools.

Overall, forex in HK is a dynamic market with many risks and rewards. By doing your research, practising good risk management techniques, and working with a trusted forex broker, you can maximize your chances of success and enjoy the benefits of this exciting financial activity.

Conclusion

Suppose you are interested in forex trading in Hong Kong and want to take advantage of this market’s many opportunities. In that case, various resources are available to help you get started. Whether a beginner or an experienced trader, you must familiarize yourself with the key factors influencing commodity prices, such as supply and demand, economic news and data releases, and local market conditions. Additionally, by using forex trading platforms wisely and working with a trusted broker, you can minimize your risks while taking advantage of opportunities in this exciting financial activity.